r&d tax credit calculation example

Use our simple calculator to see if you qualify for the RD tax credit and if so by how much. So while an in-house resource or online RD tax credit calculator may be a good starting point we always recommend you work with a reputable RD tax credit service provider.

R D Tax Credit Calculation Examples Mpa

His deemed hourly rate is 60000yr.

. Assuming your business fits these criteria you can check below for example calculations for RD tax credits. Your business has made profits of 650000 for the year With Corporation Tax at 19 youll be expected to pay 123500 Your business spent 120000 on RD expenditures. RD tax credits one size does not fit all The calculation method that yields the maximum benefit the best reduction in your overall tax burden depends a lot on your individual business circumstances.

Find the greater of the base amount or 50 percent of current year QREs. In general the RRC method may be best for taxpayers with low base amounts or for new startups. Let our experts research and provide information that you need to understand how this credit can genuinely benefit your business.

So if your RD spend last year was 100000 you could get a 25000 reduction in your tax bill. RD tax credits calculator Get in touch Were here to help Get a quick estimate of your potential claim value Drag the slider or enter your estimated spend value below to view your claim value against your RD spend. This credit appears in the Internal Revenue Code section 41 and is earmarked for businesses that have costs related to research and development.

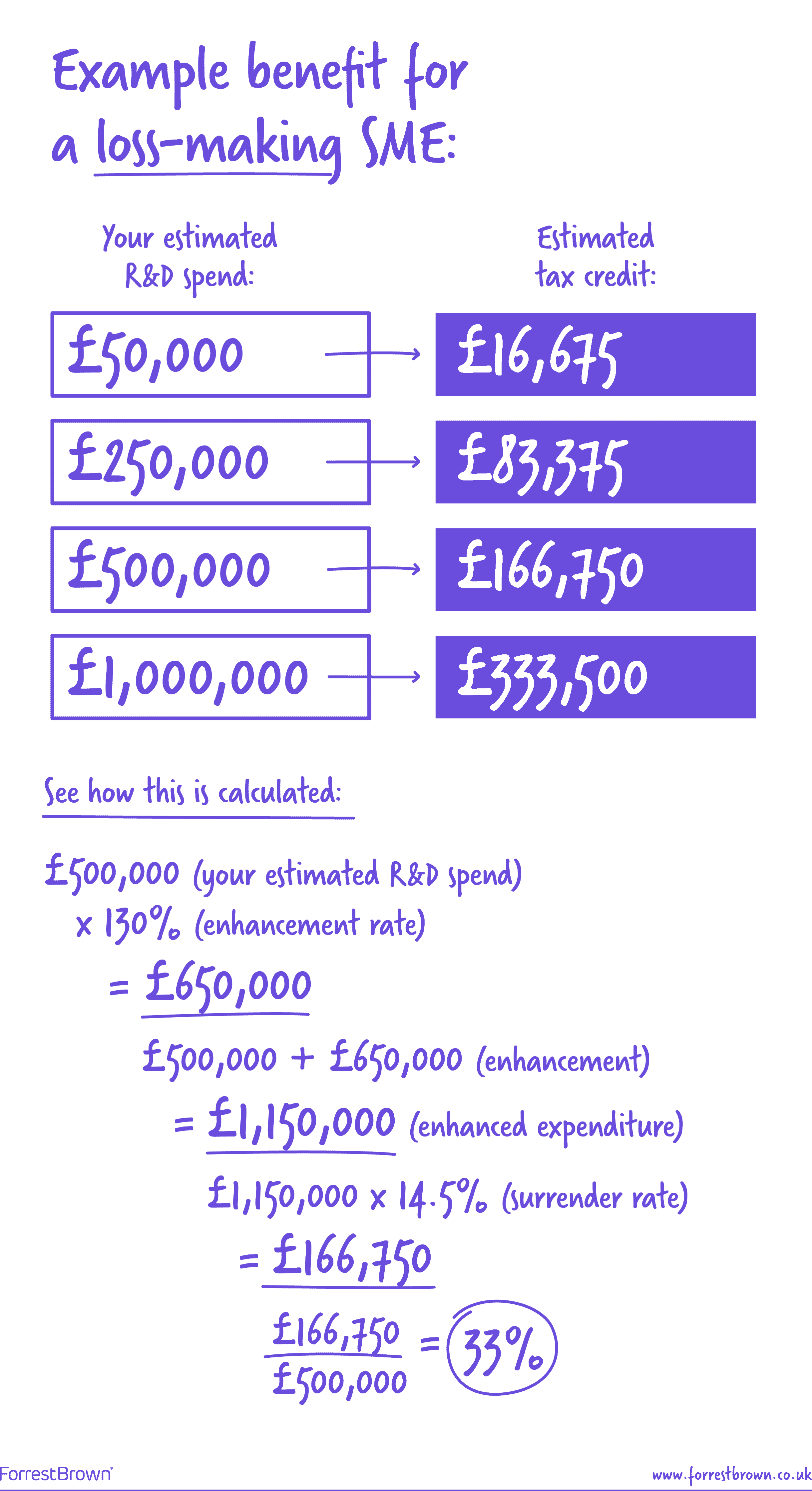

Traditional method Under the traditional method you ger research credit 20 of the companys current year qualified research expenses over a base amount. The credit benefits large and small companies in virtually every industry yet our research shows many businesses are leaving money on the table. Loss Making SME Calculation Large Companies RDEC Profitable and loss making large companies equaly can benefit both potentially obtaining a RD Credit of 97 of their RD spend.

What are the methods of computation of R D Tax Credits. Calculate Your claim estimate. This is a company that made 10000000 profit that year with qualifying RD spend of 3000000 and corporation tax of 1900000.

The rate of relief is up to 33. Now as appears from the above youve carried out RD activities and youve calculated the qualifying expenditure to be 100000. Add the annual QREs over the previous four years.

If youre a loss-making business youll receive your RD tax credit in cash because you dont have a tax liability to offset. RD tax credit examples include. The RD Tax Credit Calculator is best viewed in Chrome or Firefox.

70000 - 24167 45833 x 14 6417 If the company had no research expenses in any of the previous three years the tax savings is 6 of qualified research expenses for the current year. The ASC method is often better suited for companies that have a high base amount or incomplete records from the base period or those that have been complicated by mergers and acquisitions. In other words your RD expenditure will now be 130000 and your revised profit will be 370000.

Bob the lab technologist makes 60K per year. The above RD tax credit calculation example shows several steps to arrive at the corporation tax saving. Multiplied by 14 equals credit.

Bob spent 200 hours of qualifying work on Project 1 during FY19. And we do not want to stop here without helping you. A Profitable SME RD Tax Credit Calculation Lets assume the following.

Multiply the result in step 3 by the fixed base percentage. The rate of relief is 25. RDEC Scheme calculation that was either profit or loss making and spent 1000000 on qualifying RD activities in a given year.

1000000 x 12 120000 above the line credit 120000 19 corporation tax rate 97200. 1000000 Your spend estimate 50000 Previous Next Insights direct to your inbox. There are two methods of computation of R D tax credits -Traditional Method and Alternative Simplified Credit Method.

The RRC is an incremental credit that equals 20 of a taxpayers current-year QREs that exceed a base amount which is determined by applying the taxpayers historical percentage of gross receipts spent on QREs the fixed-base percentage to. For example software companies that invest in their technology. Its available at the federal and state level with over 30 states offering a.

Here is a SRED calculation example for payroll. The RD tax credit is available to companies developing new or improved business components including products processes computer software techniques formulas or inventions that result in new or improved functionality performance reliability or quality. Therefore the payroll SRED expense for Bob is 6000.

If the company spent 100000 on RD projects in a year then its potential RD Credit would be 33350. Add the total QREs for the current tax year. This is the base amount.

Find the fixed base percentage. Corporation Tax Saving. Calculate Your RD Tax Credit In 2021 alone alliantgroup delivered over 23 billion in credits and incentives to over 14000 businesses.

An RD service provider will assist in determining qualified activities the associated costs as well as maximizing the benefit to. If in 2022 A to Z Construction had qualified research expenses of 70000 they would calculate the available RD credit as follows. Youll therefore multiply this amount by 130 and deduct the result from your original profit.

73150 pre-claim Corporation Tax 48450 post-relief Corporation Tax 24700 saving or refund Calculating RD tax credit for loss-making SMEs Loss-making SMEs should also start by calculating their qualifying expenditure although the sums after that will be different as the RD spend increases losses. 4 The RD tax credit was first established in 1981 in the Economic Recovery Tax Act ERTA. According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in 2020106 billion for corporations and 12 billion for individuals.

To get specific you calculate and report the credit on IRS form 6765 and submit it with your companys tax return. RD Tax credit is a non refundable amount that taxpayers subtract from their total taxable income when filing taxes.

R D Tax Credit Calculation Adp

R D Tax Credit Rates For Sme Scheme Forrestbrown

R D Tax Credit Calculation Examples Mpa

Taxtips Ca 2021 Non Refundable Personal Tax Credits Base Amounts

The Amt And The Minimum Tax Credit Strategic Finance

R D Tax Credit Calculation Methods Adp

The R D Tax Credit Aspects Of Saas Start Ups R D Tax Savers

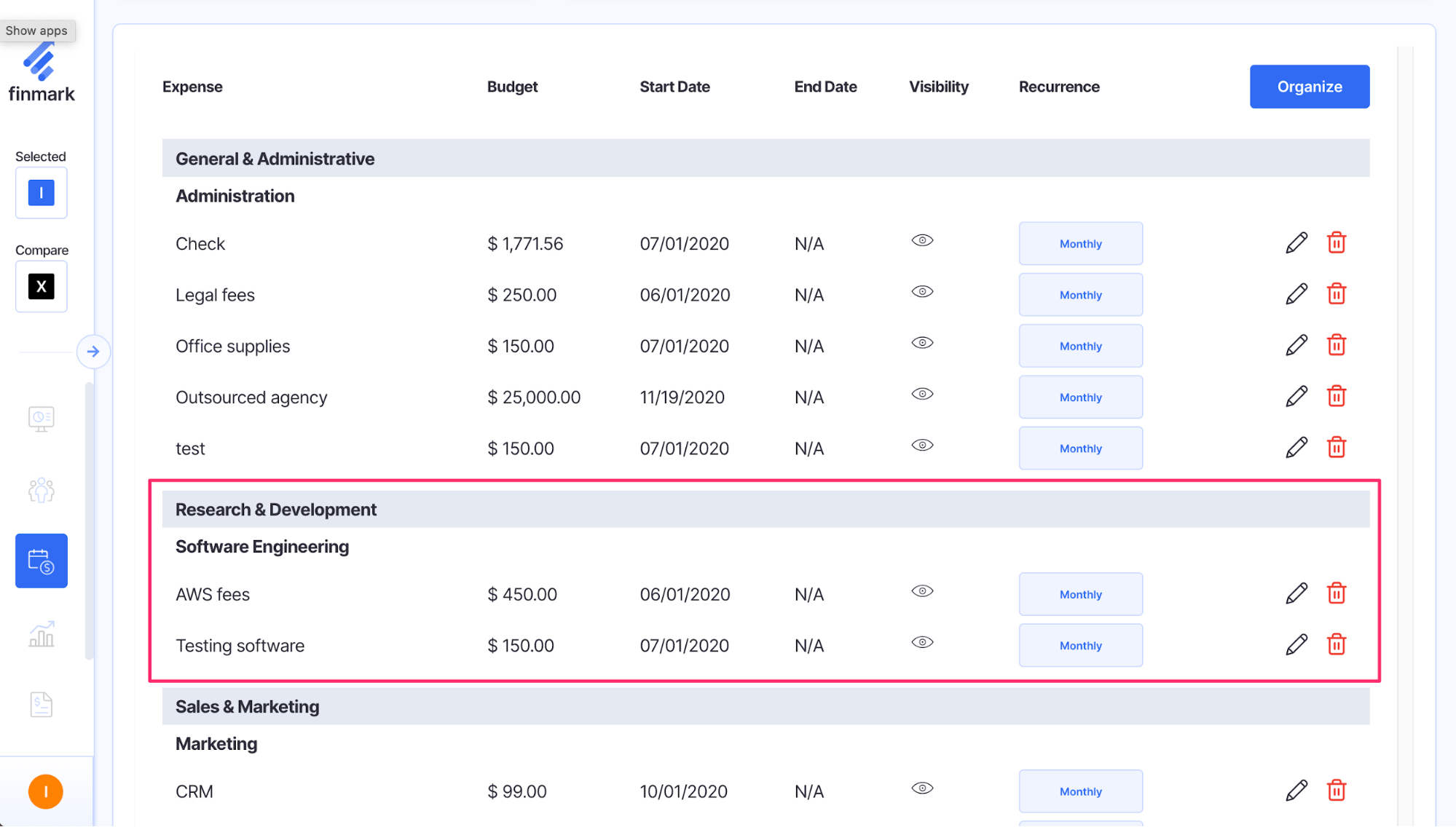

Research And Development Expenses R D Expense List Finmark

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

R D Tax Credit Calculation Methods Adp

Rdec Scheme R D Expenditure Credit Explained

R D Tax Credit Rates For Rdec Scheme Forrestbrown

R D Tax Credit Calculation Methods Adp

What Are Marriage Penalties And Bonuses Tax Policy Center

A Simple Guide To The R D Tax Credit Bench Accounting

R D Tax Credit Calculation Examples Mpa

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)